Paris Real Estate : Insights from 2023 and Forecasts for 2024

2023 was a crazy year for Parisian real estate with many unprecedented factors all colliding into the perfect storm.

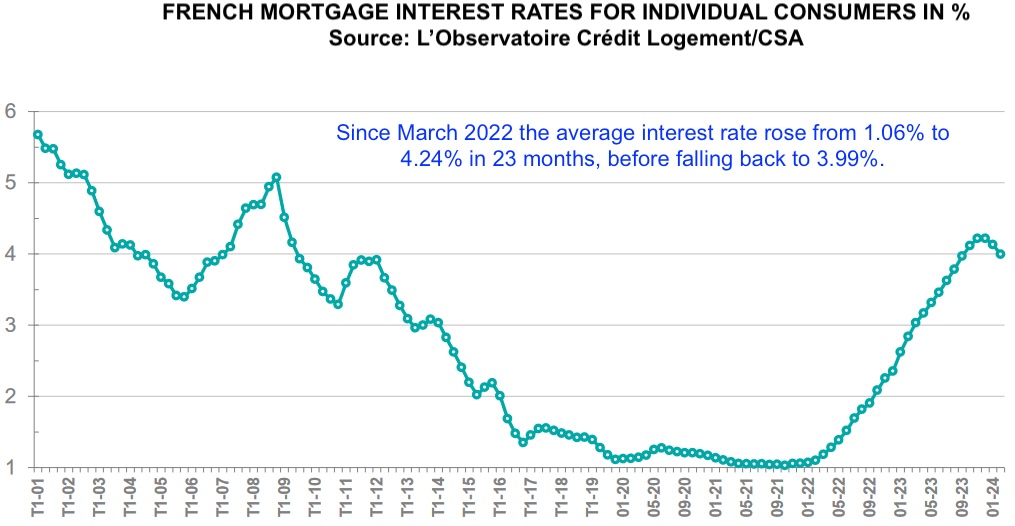

First we saw mortgage interest rates rapidly climb to their highest peak in over 14 years.

Between 2000 and early 2002, French mortgage rates (for resident buyers) were around 5 to 5.50%. They fell until 2005, reaching a low of less than 4% but rose again until 2009 and the subprime crisis, to return to over 5%.

Since peaking in 2009, French mortgage interest rates fell gradually until early 2022, hovering just above the almost too good to be true rate of 1.00%. With economic pressure from the war in Ukraine and other global events, central banks around the world started raising interest rates to combat rising inflation.

Since March 2022, the average mortgage interest rate in France rose from 1.06% to 4.24% in 23 months, before falling back to 3.99%. This created a massive shock to the French real estate market.

Already losing purchasing power from inflation, suddenly many prospective home buyers could no longer afford mortgage payments at the new rates. Real estate transactions fell, prices started to soften and anyone who didn't need to sell took their property off the market. This was particularly the case in Paris.

Did you take a French mortgage in 2023?

Not to worry – just like with all our clients who borrowed at the height of rates in 2005, rates will come down in time and you can refinance. The rule of thumb is that the proposed interest rate must be 1% less than what you have in order for you to save money with a refinance. French banks offer fixed rate mortgages that are fixed for the entire loan duration but as our favorite French banker likes to say “France only offers variable rate mortgages that vary on the way down.”

At the moment, we are getting mixed messages from our bank partners with some dropping rates considerably in February and others remaining cautious and keeping rates stable. One thing is clear, mortgage sales were very low for all French banks last year so they will need to start lending soon with more flexibility in 2024 to make up for those losses.

“In over twenty years of doing business, we had never seen the French banks stop lending.”

Next we had the French “Taux d'usure Crisis”

The taux d'usure is the maximum legal interest rate that banks are allowed to charge in France. It's somewhat similar to the American APR in that it incorporates some other charges linked to borrowing to buy real estate such as insurance and part of the closing costs. This rate is updated each quarter by the French government. As interest rates in 2023 were skyrocketing on a monthly basis, the taux d'usure was completely out of touch with market reality.

Many people don't realize that most banks have to borrow funds from their central government bank to lend to consumers. They do this because the money people deposit in their bank accounts is not enough to be able to lend money as mortgages and still maintain the required capital reserves to protect against an economic downturn. Banks purchase money wholesale to lend at retail rates.

With interest rates rising so fast, the wholesale cost of borrowing for the banks was bumping up against the maximum legal lending rate in France. It began to cost the French banks money to lend to clients last year . Most of them made their lending criteria so difficult that few clients qualified and some of them simply stopped lending. In over twenty years of doing business and countless economic crises (Sub prime crisis, 9/11, the Lehman Brothers bank default in 2008, the Greek Euro crisis in 2015, Covid), we had never seen the French banks stop lending.

The French government finally changed the taux d'usure to be updated on a monthly basis mid 2023 and banking slowly started to recover in December. They are back to quarterly updates now as of January 2024 which is a strong sign that French mortgage interest rates have stabilized. We are proud to say that we were one of the few French mortgage brokers who continued to be able to secure mortgages for our clients, both resident and non resident, in 2023.

Lastly, to top off the perfect storm, the new home energy efficiency laws began to take effect in France.

The French government has voted in the “Loi Climat et résilience” regarding home energy efficiency in order to help keep it's citizens warm (or cold) enough during our worsening climate crisis. The goal is to reduce greenhouse gas emissions and reduce gas and electricity consumption.

Homes with the lowest energy efficiency ratings (Diagnostic de performance énergétique or DPE) will soon be banned from the rental market unless they undergo renovations to make them more energy efficient.

From January 1, 2023, properties with the lowest energy efficiency (G) and which consume over 450kWH per square metre per year, will no longer be able to be rented out. This rule will extend to all G-rated properties from 2025, all F-rated properties from 2028 and all E-rated properties from 2034. This has caused property values to soften for the lower ratings are buyers must anticipate renovation costs as part of the price – if they plan to rent out the apartment.

Some would say the 2024 Olympics also had an impact on the 2023 Parisian real estate market but we feel that impact is marginal.

The Perfect Storm of 2023 and Parisian Real Estate

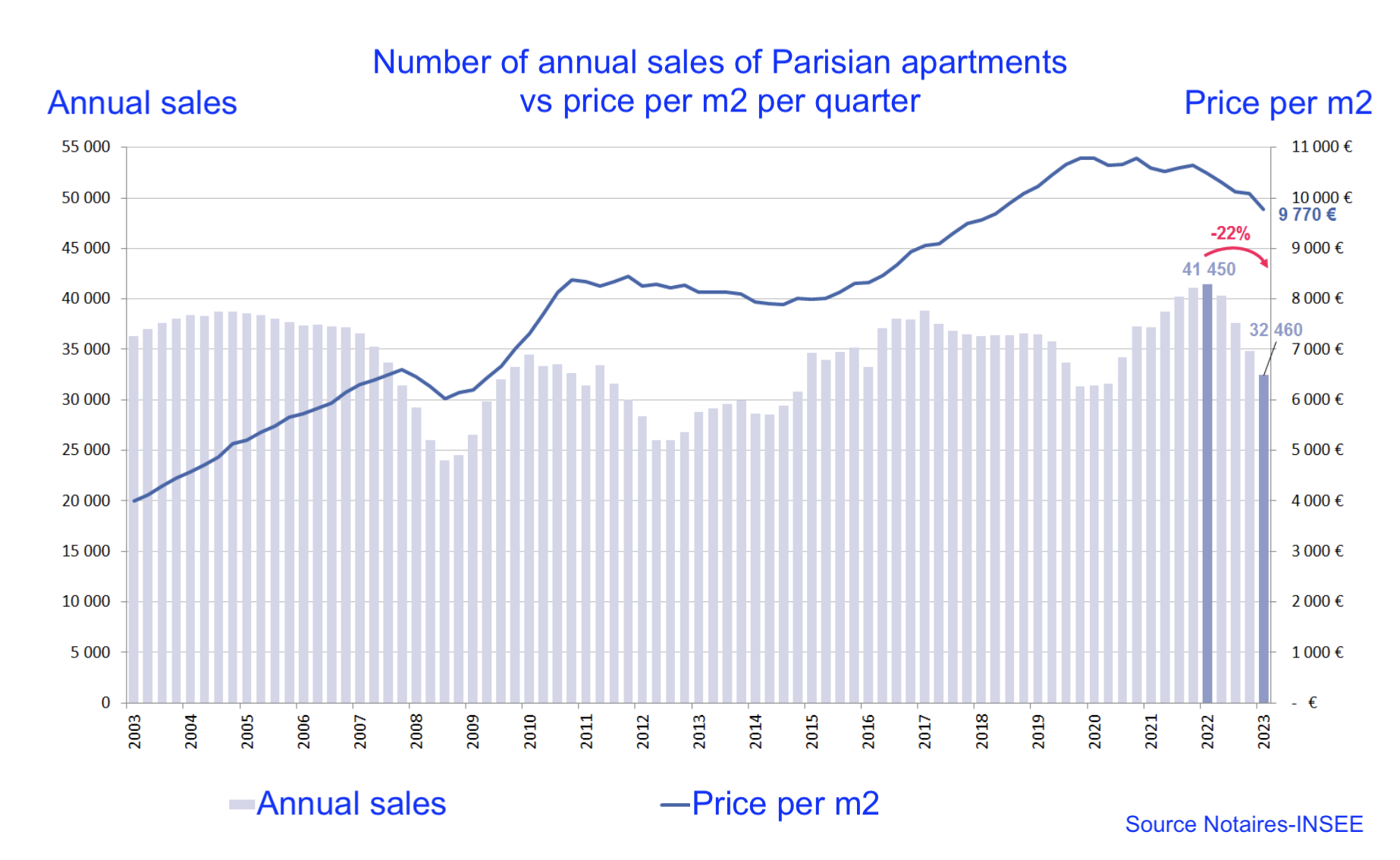

Real estate transactions were greatly reduced across France in 2023 and prices decreased in most areas. Let's look at the impact Paris.

Paris is the market that fared best across France during the downturn, albeit with a decline of 22% in real estate transactions in 2023 vs. 2022 and decline of 6% compared to the average over the last 10 years.

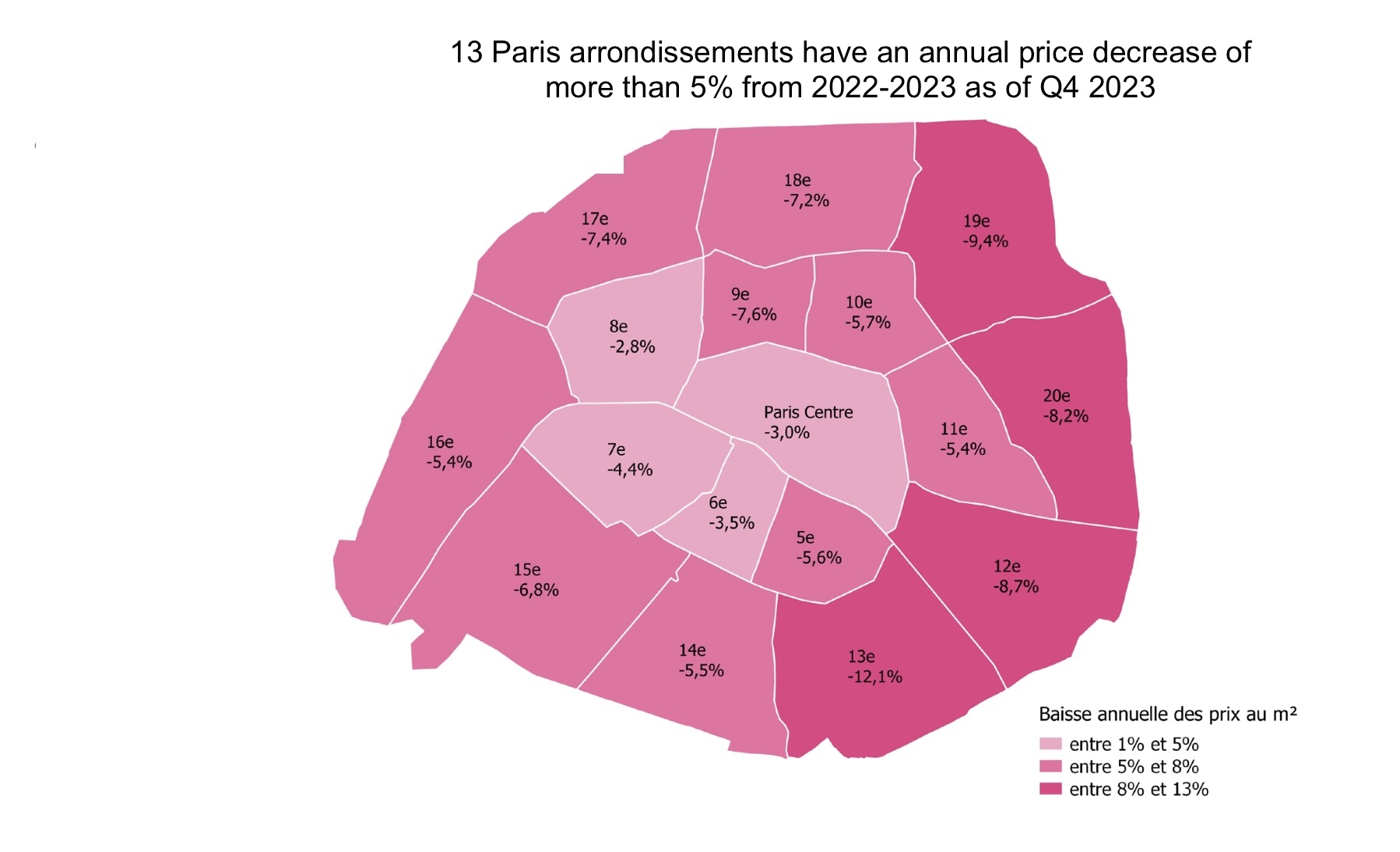

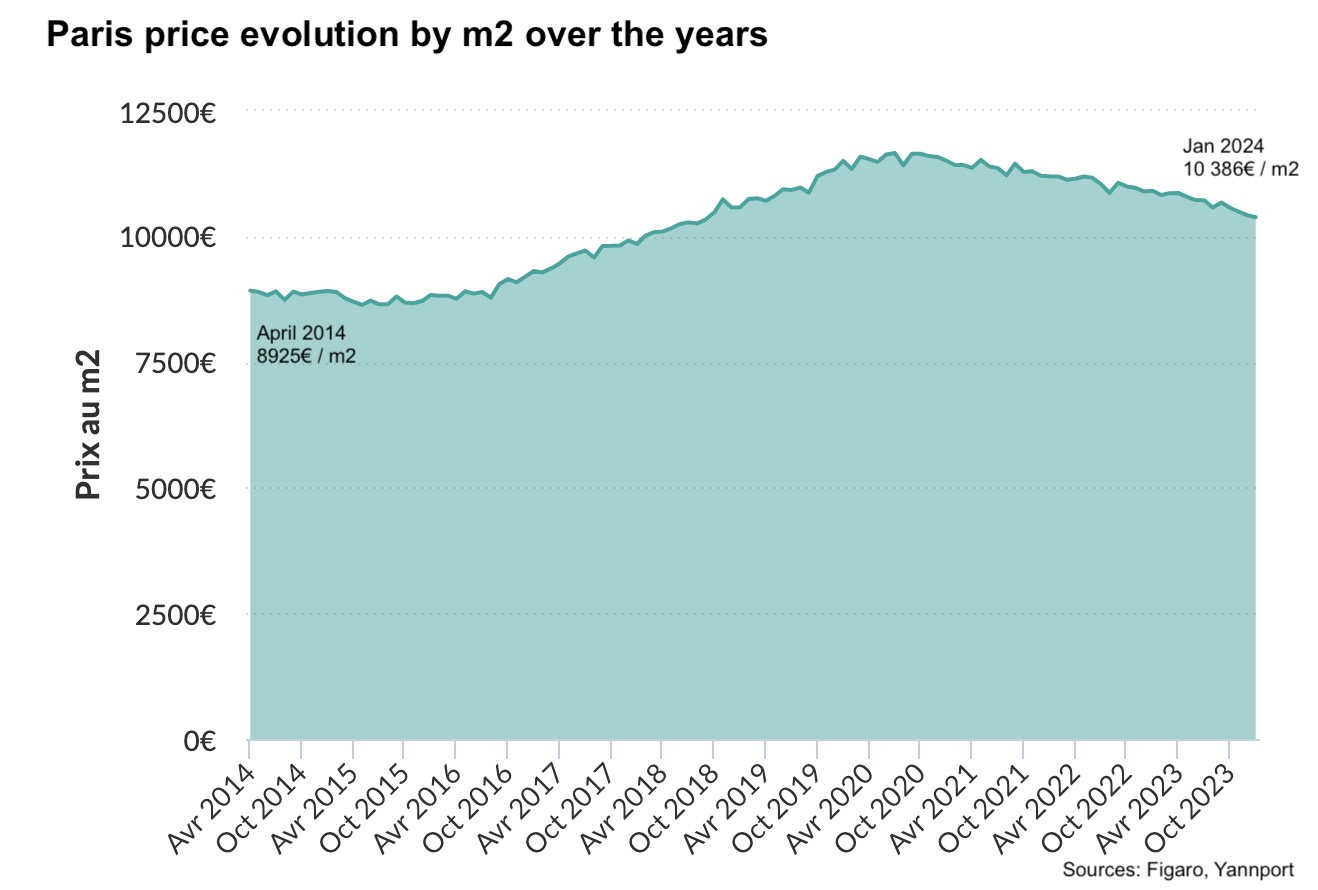

After an initial phase of resistance where Parisian sellers refused to drop price to enable a sale, those who had to sell (moving, divorce, estate settlement, etc) began to slowly fall in line. As of the 4th quarter of 2023 average Paris real estate prices were down by 6% to 8% year-on-year.

The Chamber of Notaires of Paris predict that the price decline is set to gradually continue in spring 2024, and their outlook for the coming months remains downbeat despite positive announcements by some banks of reduced mortgage interest rates to come which should kickstart the market and increase demand, therefore stabilizing price.

“Prices for premium Paris apartments are much more resistant to market shocks than the rest of the market.”

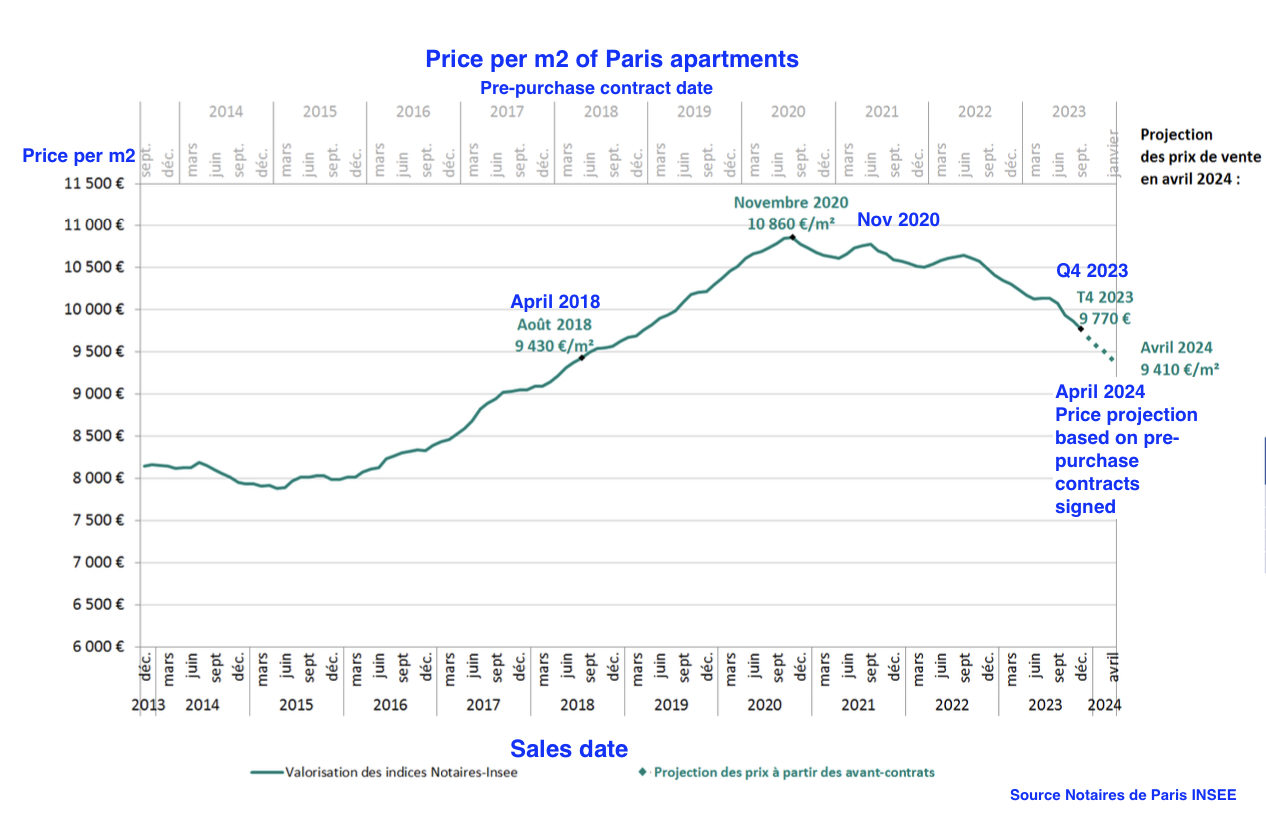

Looking back at 2023, after a phase of gradual price erosion at the beginning of the year, the price decline in Paris properties became more severe from the 2nd quarter 2023 (-4.4% year-on-year), then -5.4% in the 3rd quarter, to reach -6.8% in Q4 2023.

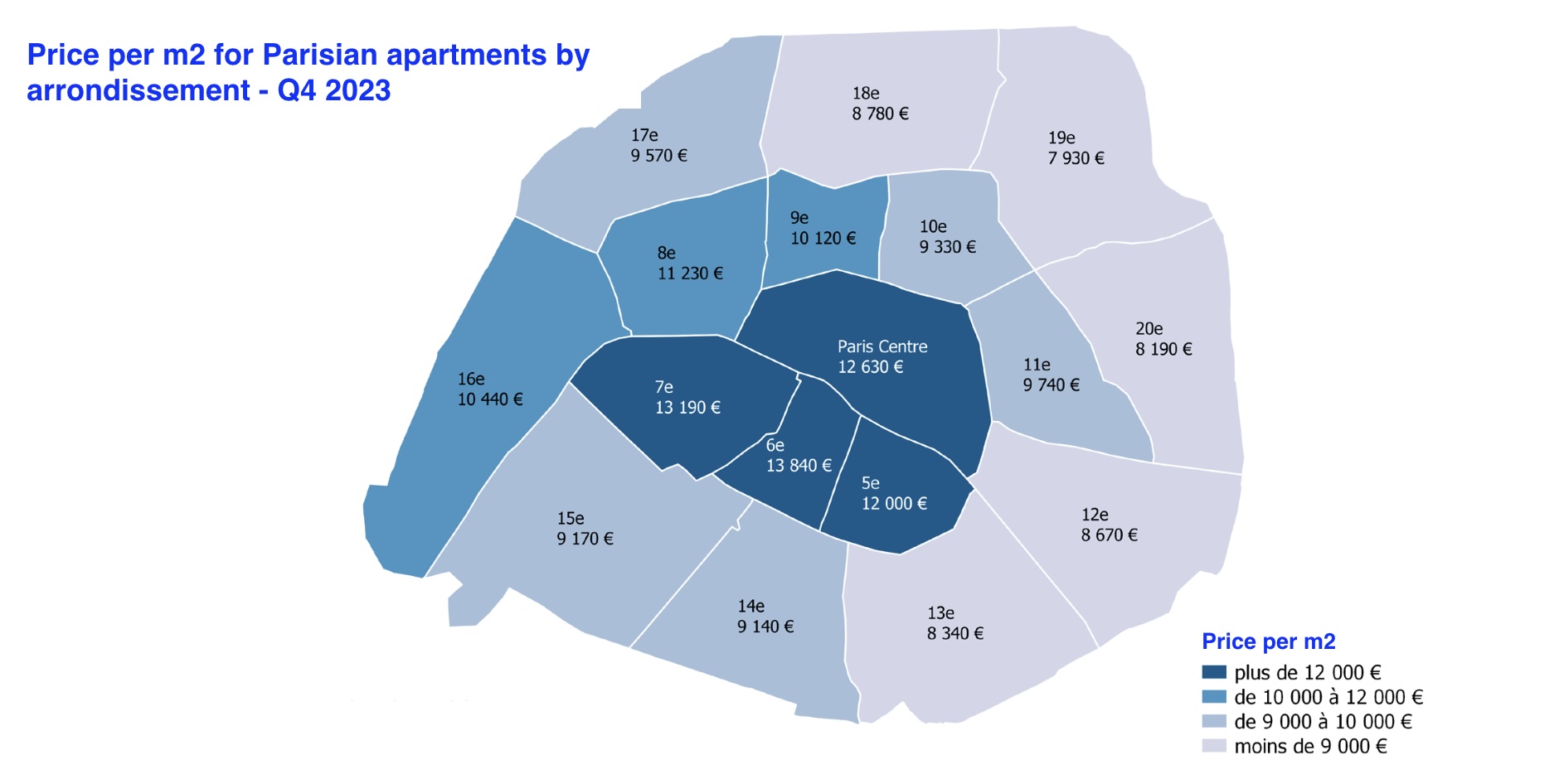

The average price per m² in Paris was €9,770 in Q4 2023.

According to the leading indicator of “promesse de vente” contracts currently signed (pre-contracts signed between sellers and buyers that close on average 3 months after), this decreasing price trend is set to continue into spring 2024. We can expect an average price per m² of €9,410 for Paris in April 2024 (-8.1% year on year). This would bring us back to average Paris real estate prices of summer 2018.

As reported by the Chambre de Notaires de Paris, the very recent stabilization of interest rates and decrease in property prices are too modest for the moment to give enough breathing space to would-be French buyers to revitalize the Parisian housing market.

We agree when speaking about the Parisian housing market in general. It's important to note that there are three markets in Paris real estate – substandard, standard and premium. As we'll explain, prices for premium Paris apartments are much more resistant to market shocks than the rest of the market.

Annual price declines range from 2.8% in the 8th arrondissement to 12.1% in the 13th. The steepest declines were mainly the least expensive arrondissements on the eastern outskirts.

“It's almost impossible to lose money by investing in a top quality Paris apartment in a good neighborhood.”

So is Paris “on sale” right now?

While we perhaps have not arrived at market stabilization after the massive shocks of 2023, it's important to remember that the Paris property has limited stock. There is a housing shortage in Paris and stable demand from international buyers moving to France or buying second homes, growing families needing larger apartments, and students coming to Paris to name but a few. We continue to have more buyers than sellers and only so many nice apartments for sale in our beautiful city. This creates a limit to how far prices can fall.

Further, Parisian sellers, many with comfortable financial situations, have historically held out against a compromise on price – preferring to wait out the downturn or instead rent their apartments as rental demand remains high. It's a very good time to buy in Paris right now but you will not see massive price discounts on the best “premium” apartments.

If you are considering investing in Paris, here's the good news – it's almost impossible to lose money by investing in a top quality Paris apartment in a good neighborhood. Looking back at 2023 and 2009, arguably the worst markets among the many economic shocks we have been through, the best apartments (if put on the market for sale) only lost about 3% of their value at the time and then bounced back.

As an example, clients who sold the apartment we found for them in 2013 at the end of 2023 sold for 18.3% higher than the initial price including closing costs and had a gain on sale of more than 300 000 euros.

“As international clients look for the best quality apartments,

the average price per m2 should be used as the bottom end of the price range in a given area.”

Keep in mind that the Paris notaire statistics used to calculate the average price per m2 take into account all Paris apartments – the ground floor, the caretaker's lodge, the maid's chambers, apartments with defects and strange layouts. The price decline is an indicator but not always applicable to the high quality apartments located in the charming, highly sought after neighborhoods that our clients typically seek (beautiful light, smart layout, classic Parisian amenities, etc.)

These apartments have held up remarkably well through the various economic crises we have seen. Further, each Paris arrondissement is split into four neighborhoods. The average price per m2 can differ by thousands between neighborhoods in the same arrondissement. As international clients look for the best quality apartments, the average price per m2 should be used as the bottom end of the price range in a given area.

Looking ahead

The market should continue to adjust over the coming months with the number of Paris property transactions increasing as many buyers and sellers move on from the wait and see stance they have been holding on to. The time to sell a listed apartment should also decrease as buyers have accepted that higher interest rates have become the new norm and sellers have had enough time to see the impact of the market shocks to sales price. Our team has been very busy since January with many international buyers actively searching the market. Our real estate agent colleagues confirm the same.

In the longer term, it is hoped that lower inflation, improved French mortgage rates and the impact of the market correction to standard and substandard Paris apartment prices will instill confidence in the general market and spur the flow of activity. And we predict that with some Parisian premium apartment owners having held back to sell in 2023, we'll see more coming on the market in the months to come.

©Tahminae Madani, Paris Buyer, March 1, 2024

Source for charts and statistics : ADSN-BIEN - Notaires du Grand Paris, Figaro, Yannport